ATTENTION: Real estate agents

Discover Real Estate's Best Kept Secret to Confidently Generate New Clients Online

...Without being an online marketing wizard, building complex funnels that don't work or wasting your money on yet another do-it-yourself real estate training program.

CLICK BELOW TO WATCH FIRST!

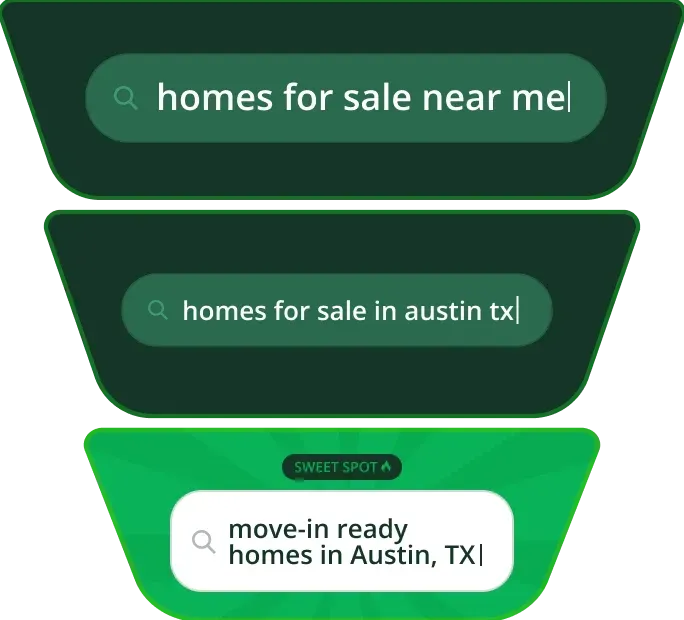

Ads That Bring in High Intent Prospects

Get in front of motivated buyers and sellers with high-converting Google Ads for real estate agents—optimized for maximum ROI.

Hyper-targeted search campaigns

Focused retargeting campaigns that bring users back

Done-for-you ads management & reporting

Proven systems optimized to get you maximum ROI

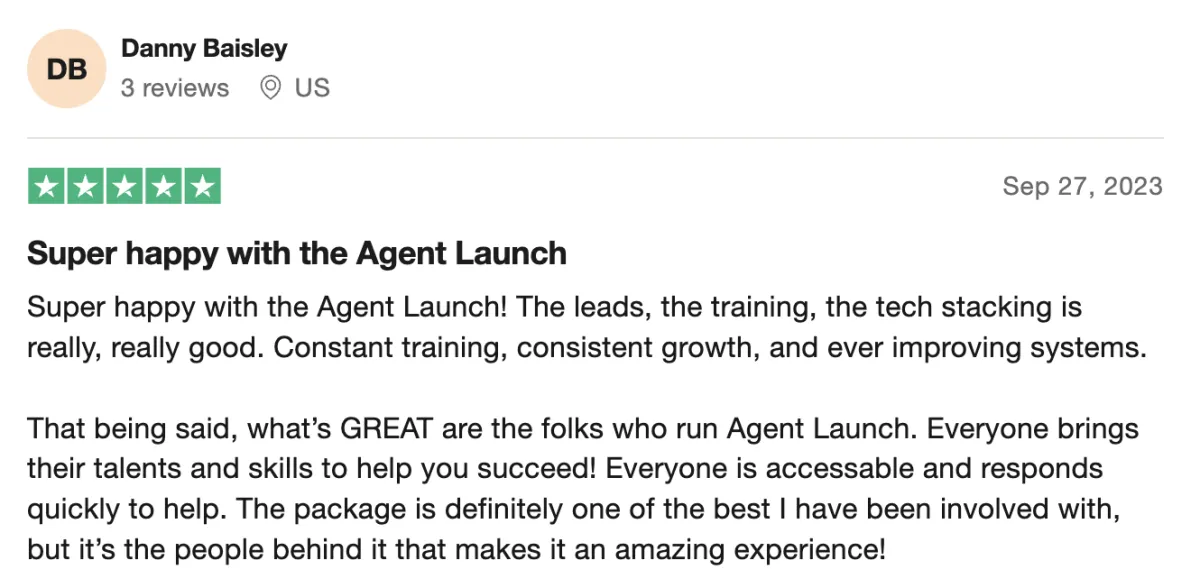

Precise Keyword & Location Targeting

Forget about generic leads - you need the right leads.

Our Google Ads focus on precision. That starts with targeting the right keywords AND the right locations WITH the right message.

Massive keyword exclusion list built via $20,000,000 in ad spend

Highest intent long-tail keywords

Highest intent niche location targeting

Trusted By

MEET THE FOUNDER

Hey, I'm Eric

I started Agent launch in 2021 to help real estate agents generate clients online. Here's why you should work with us.

Helped over 1,000 real estate agents directly

Been directly involved in generating 3,000+ real estate sales

Been on over 20 real estate podcasts

Been flown around the country to speak on lead generation

Built a loyal 35,000+ followers on YouTube

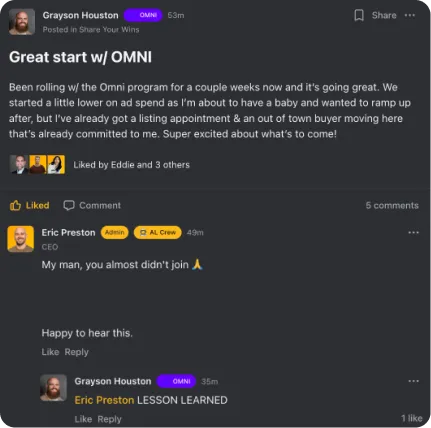

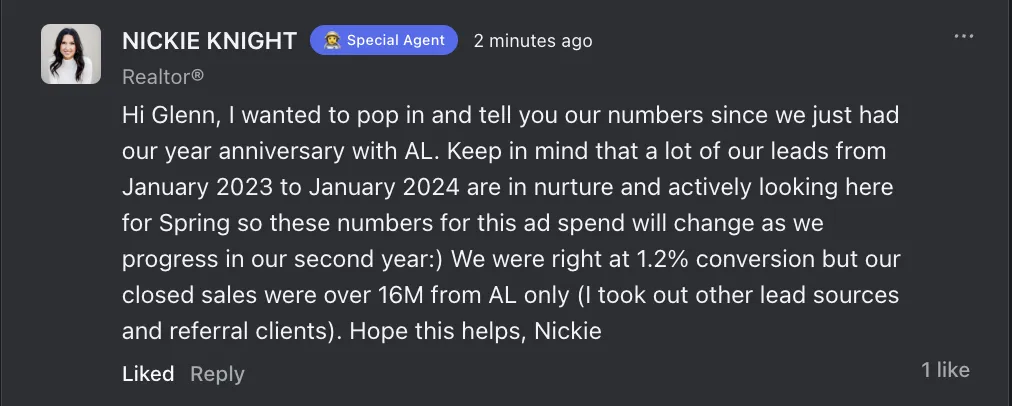

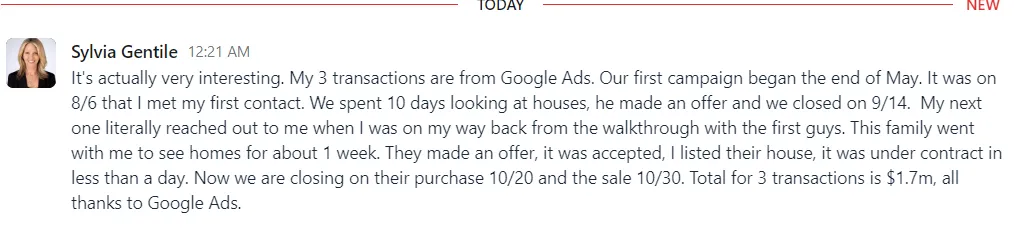

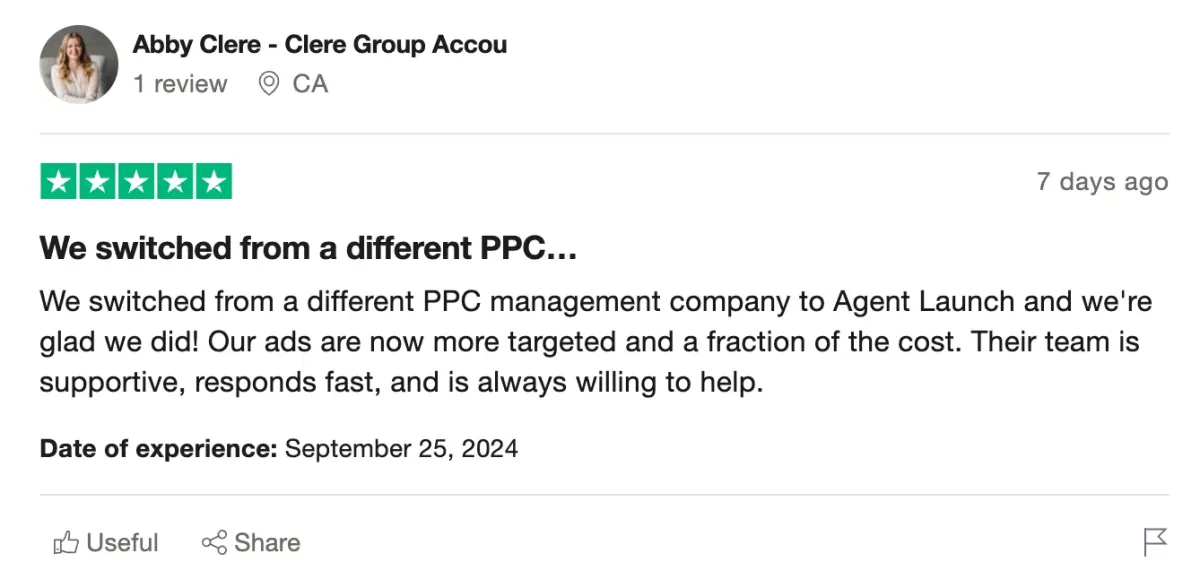

TESTIMONIALS

REAL PEOPLE, REAL RESULTS

Hear what our agents have to say.

January 20, 2025

Juan

January 10, 2025

Jake

December 28, 2024

Thomas

September 25, 2024

Abby

September 04, 2024

Zak

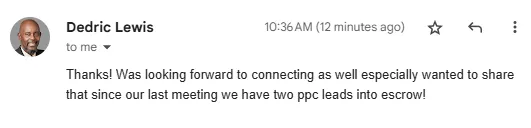

December 17, 2024

Dedric

August 14, 2024

Jeromy

August 09, 2024

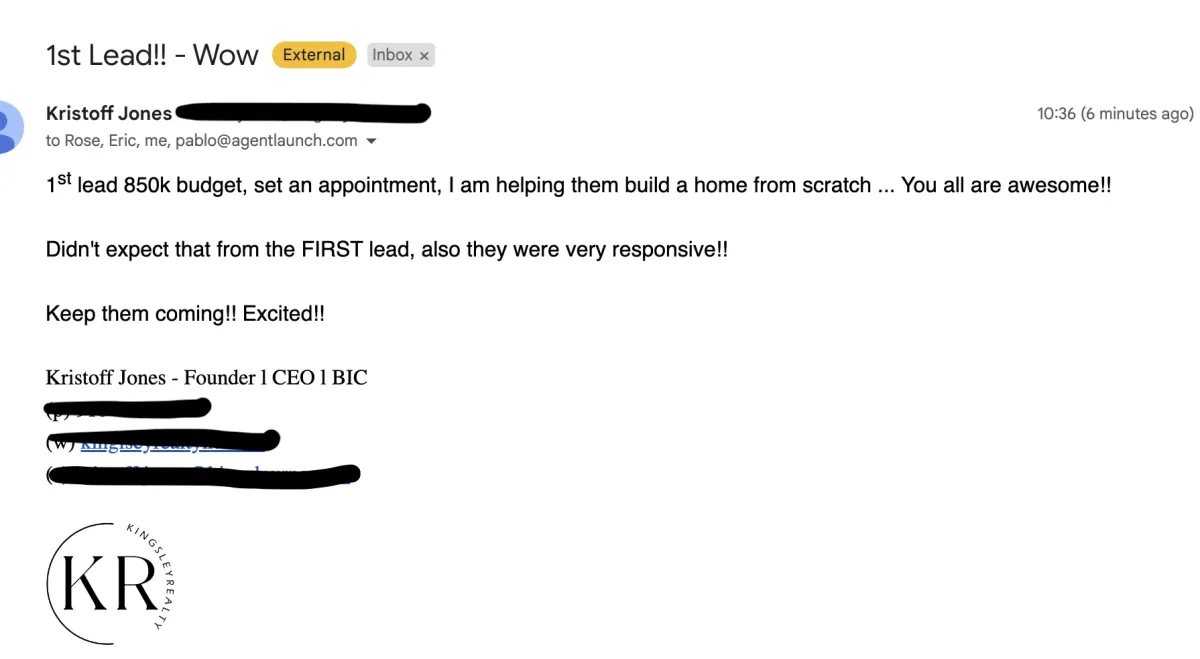

Kristoff

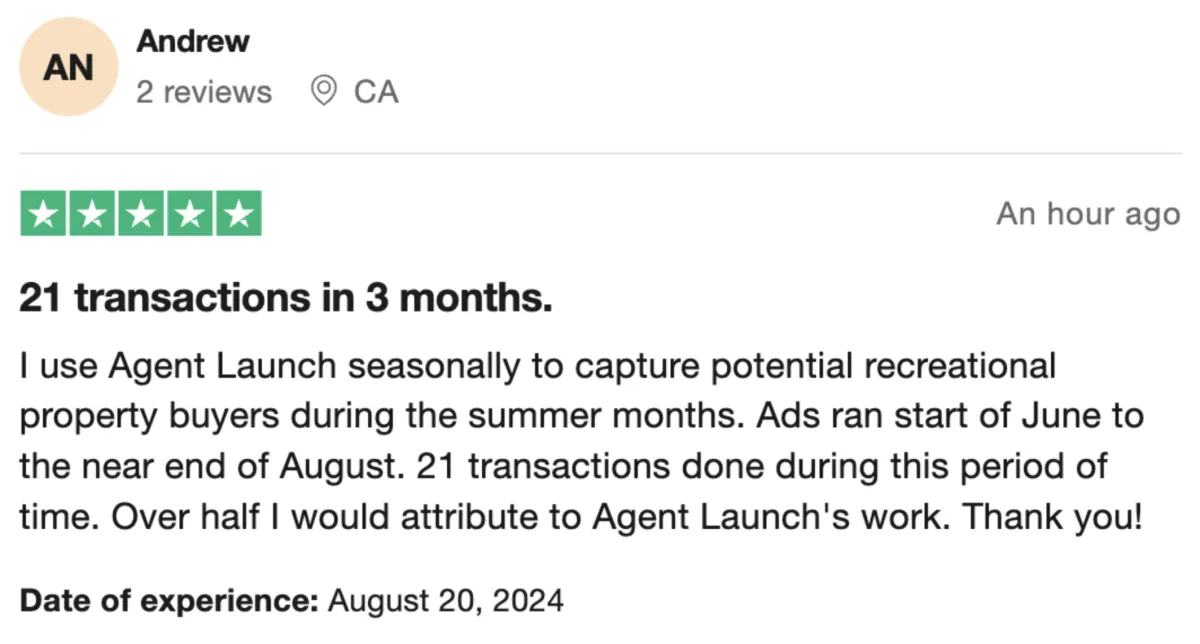

August 20, 2024

Andrew

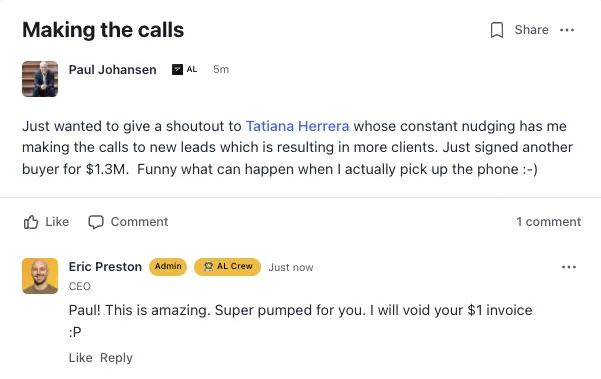

July 11, 2024

Paul

July 14, 2024

Matthew

July 25, 2024

Adam

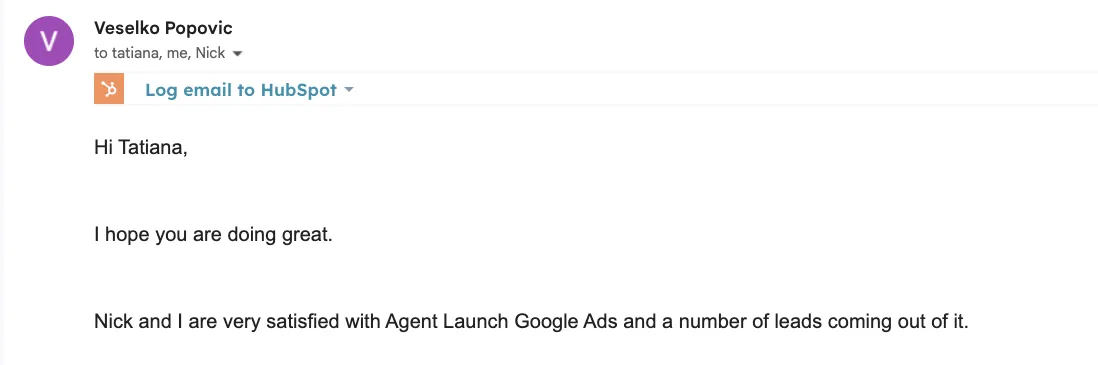

July 09, 2024

Vaselko

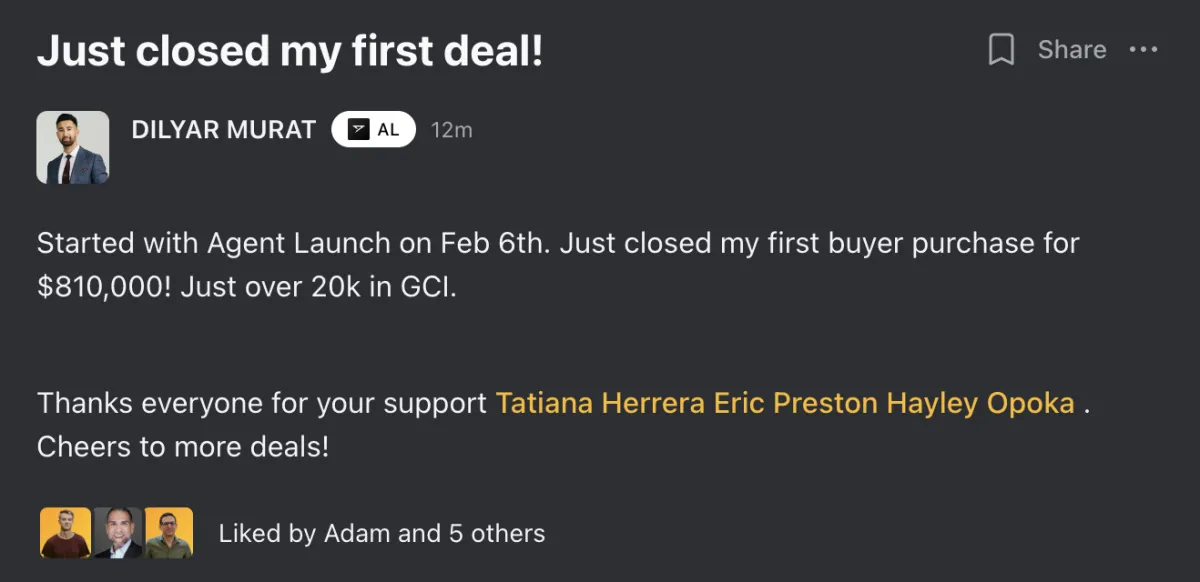

July 05, 2024

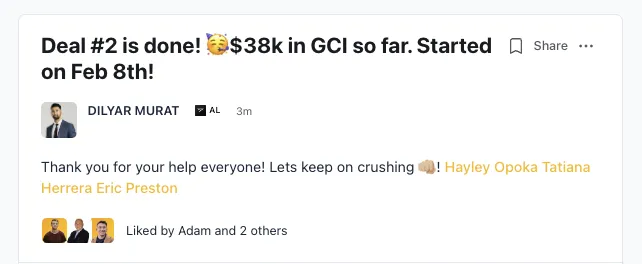

Dilyar

July 10, 2024

Andy

April 23, 2024

Dedric

April 24, 2024

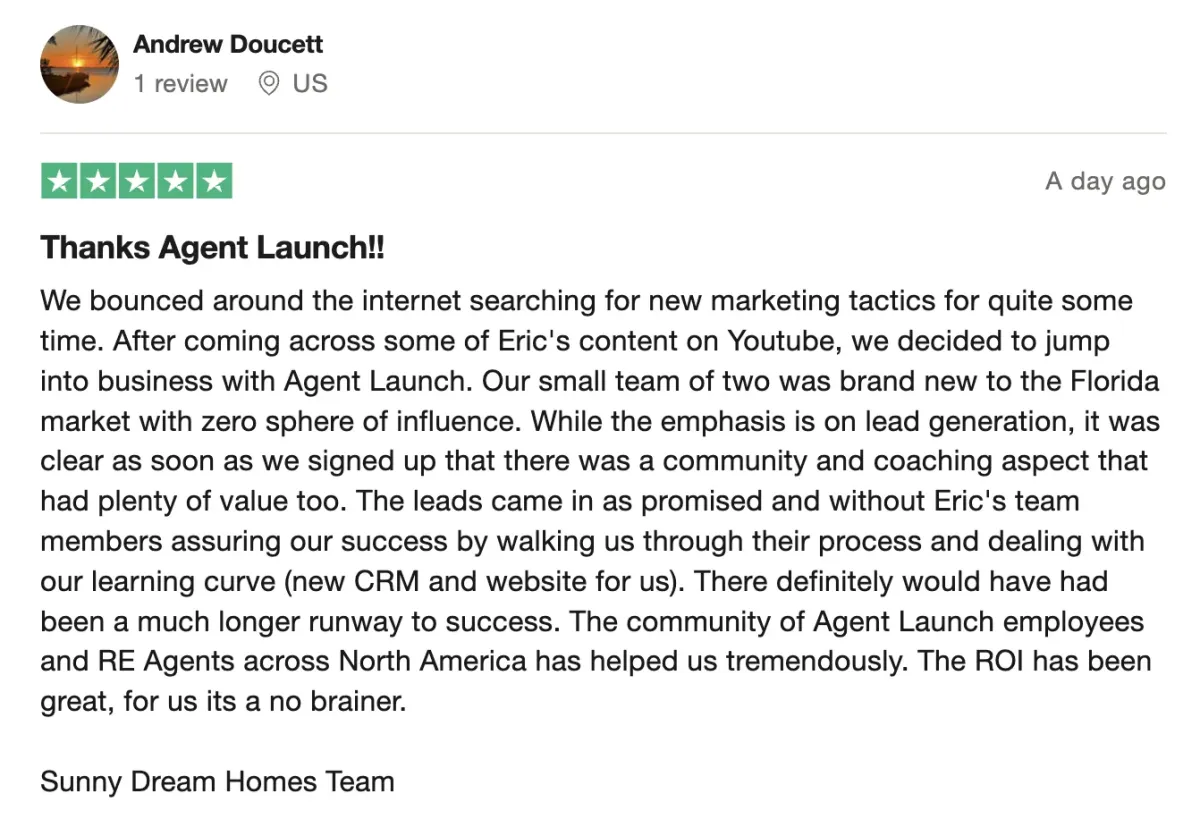

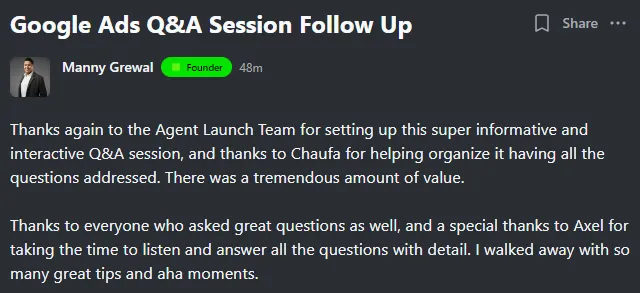

Manny

April 26, 2024

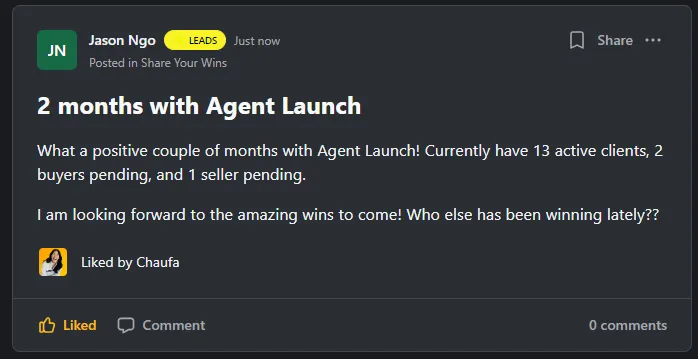

Jason

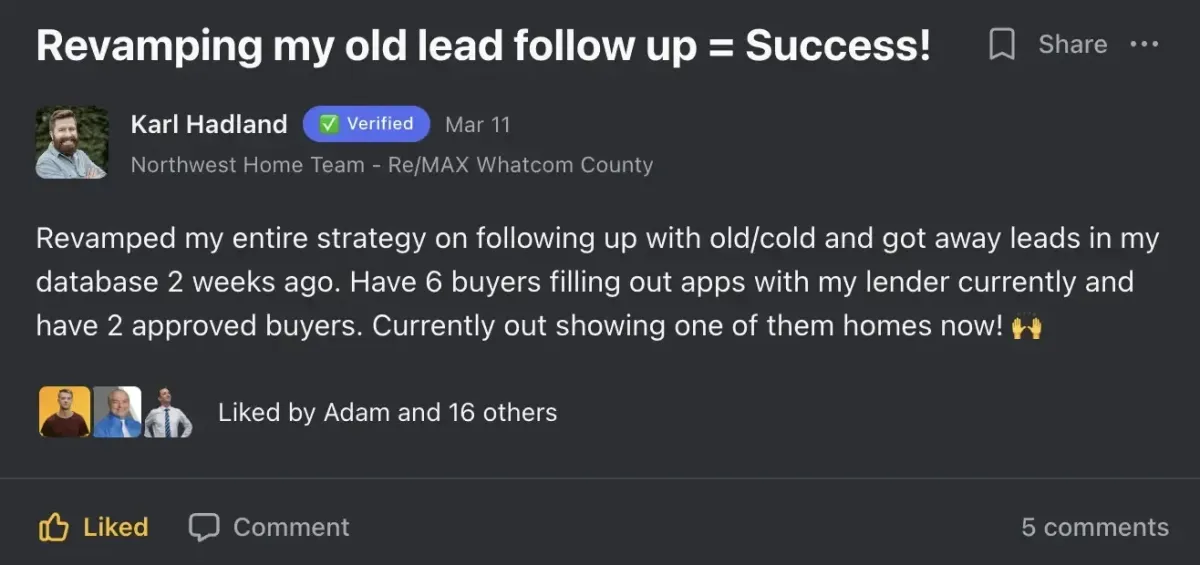

March 11, 2024

Karl

April 05, 2024

Brock

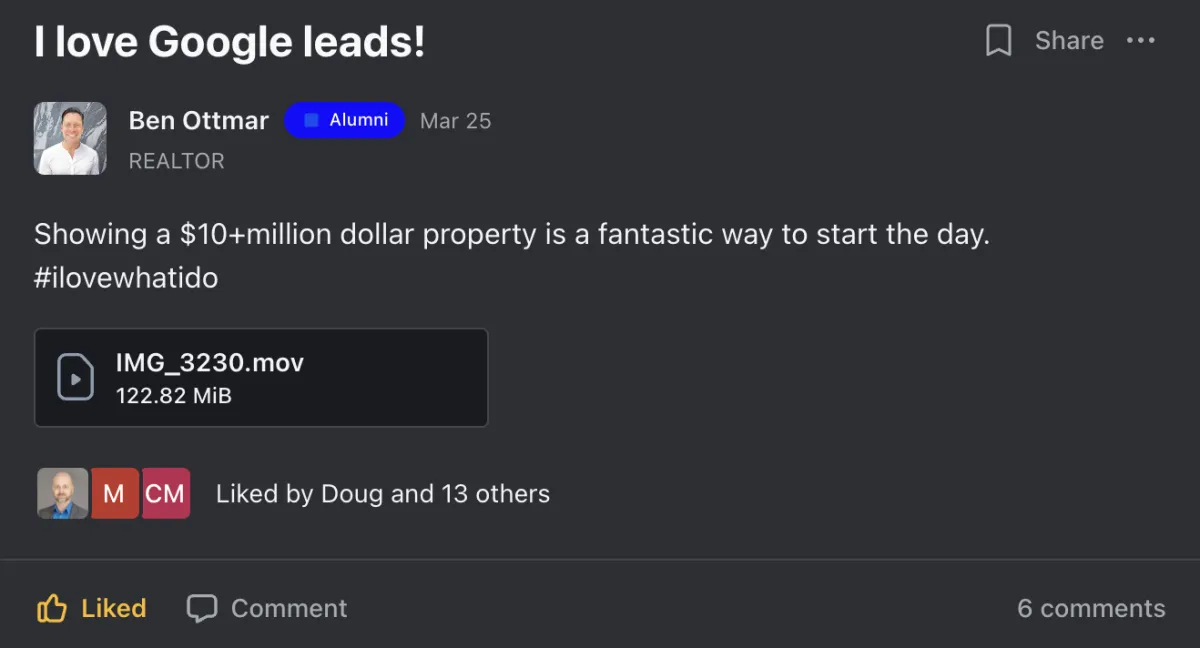

March 25, 2024

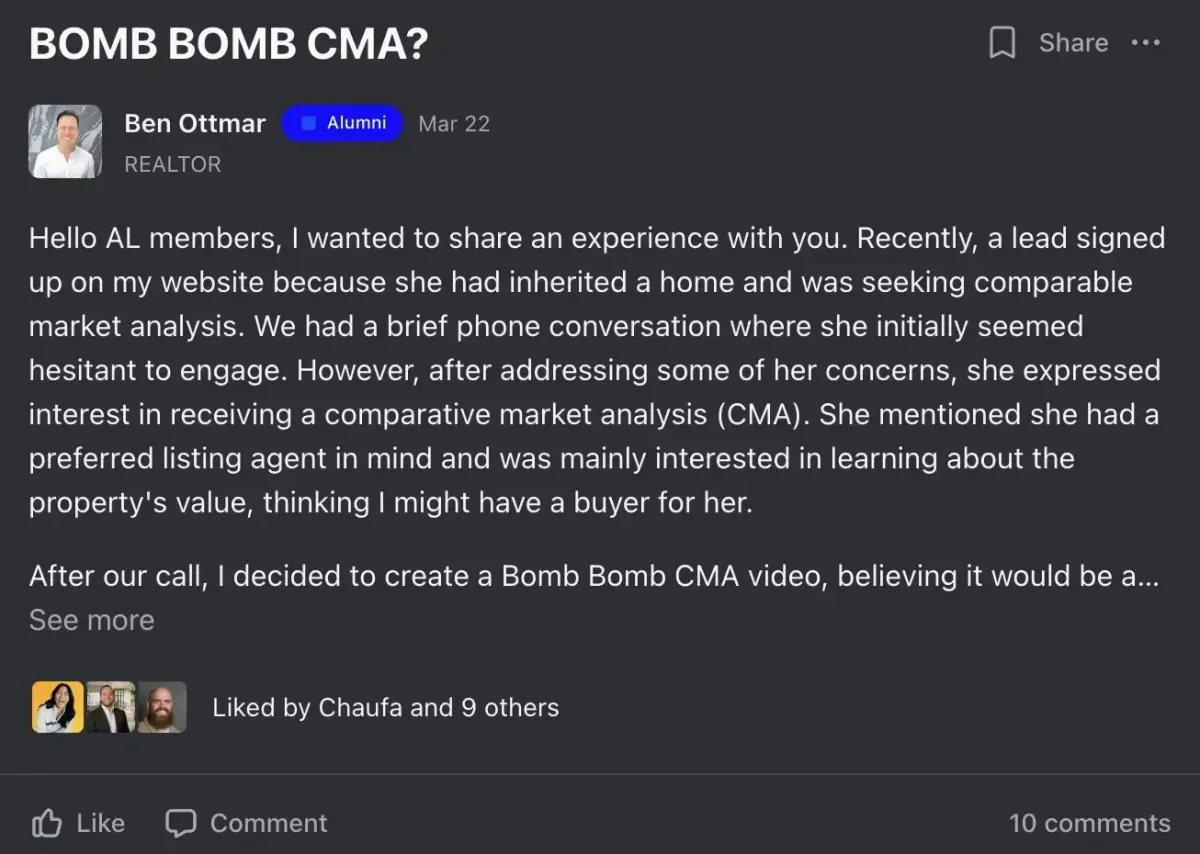

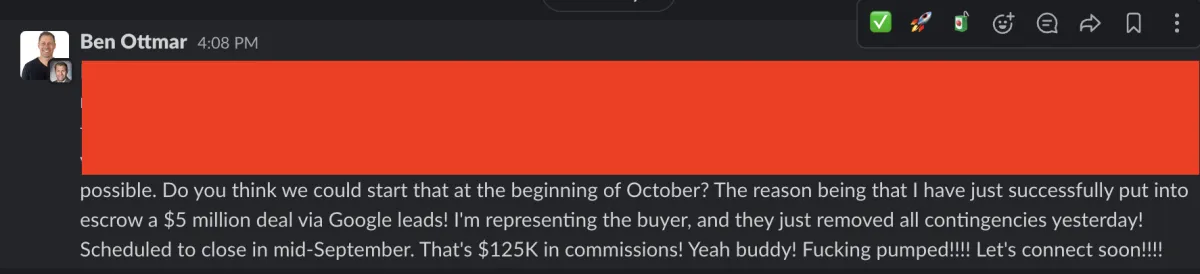

Ben

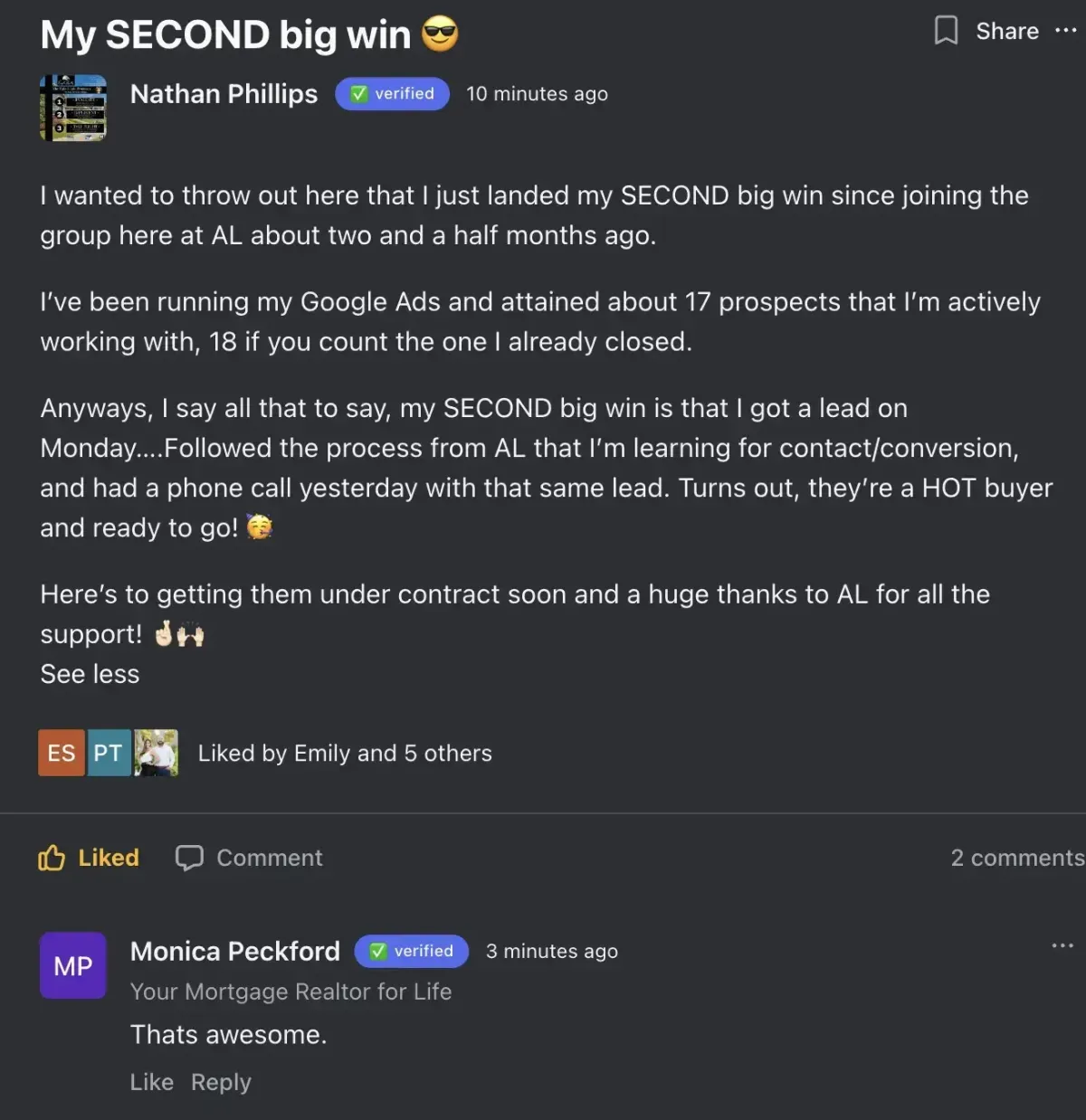

March 07, 2024

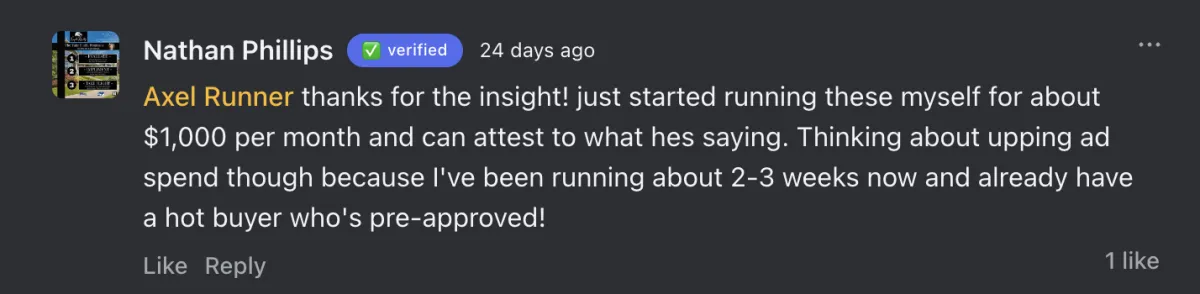

Nathan

February 28, 2024

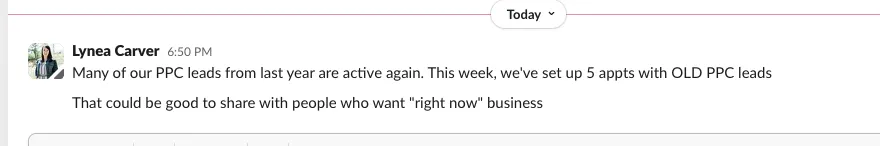

Lynea

March 22, 2024

Ben

February 09, 2024

Ben

February 26, 2024

Oksana

February 02, 2024

Nathan

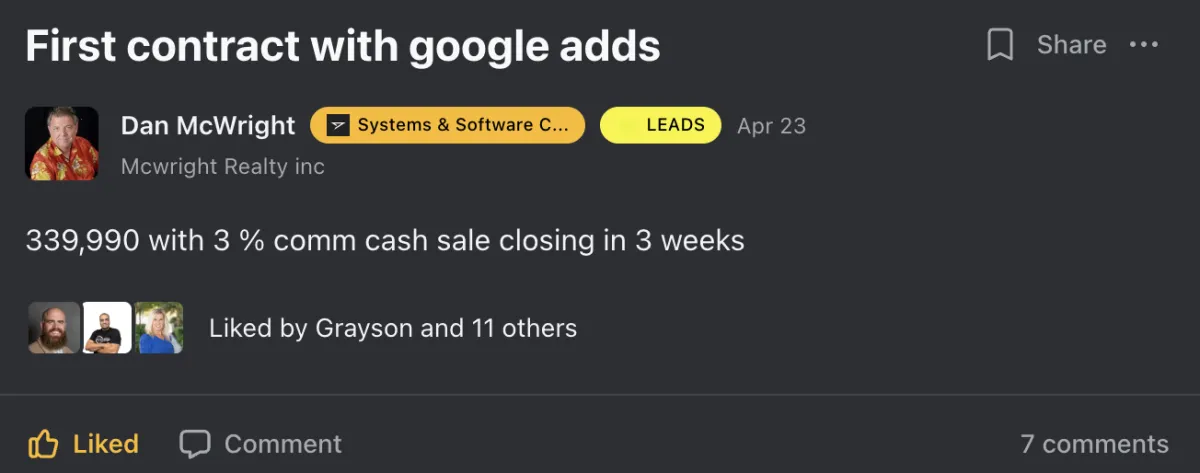

April 23, 2024

Dan

January 23, 2024

Shawn

March 21, 2024

Nathan

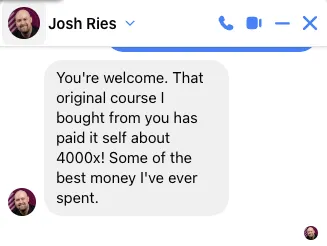

December 12, 2023

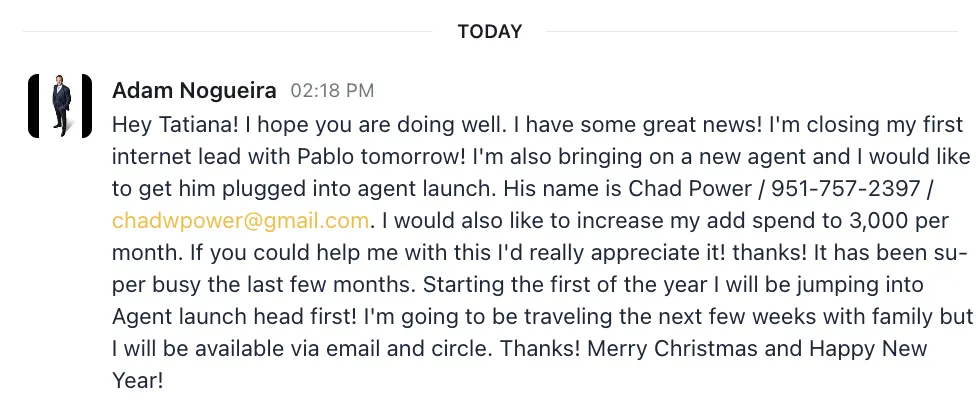

Adam

September 01, 2023

Ben

August 15, 2023

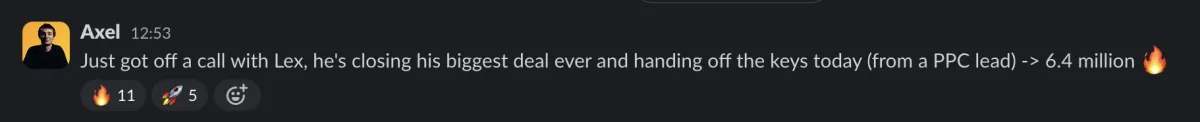

Lex

July 21, 2023

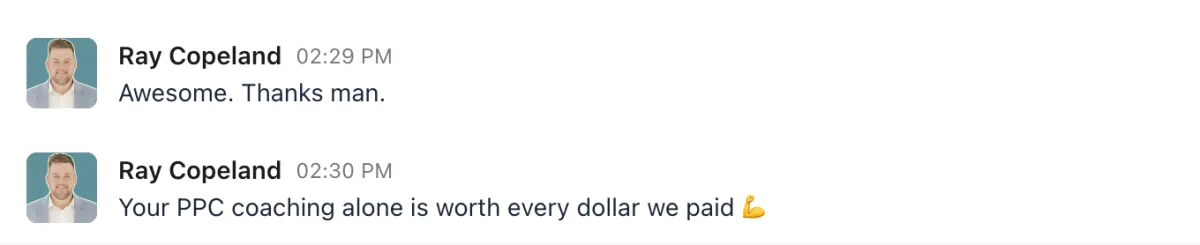

Ray

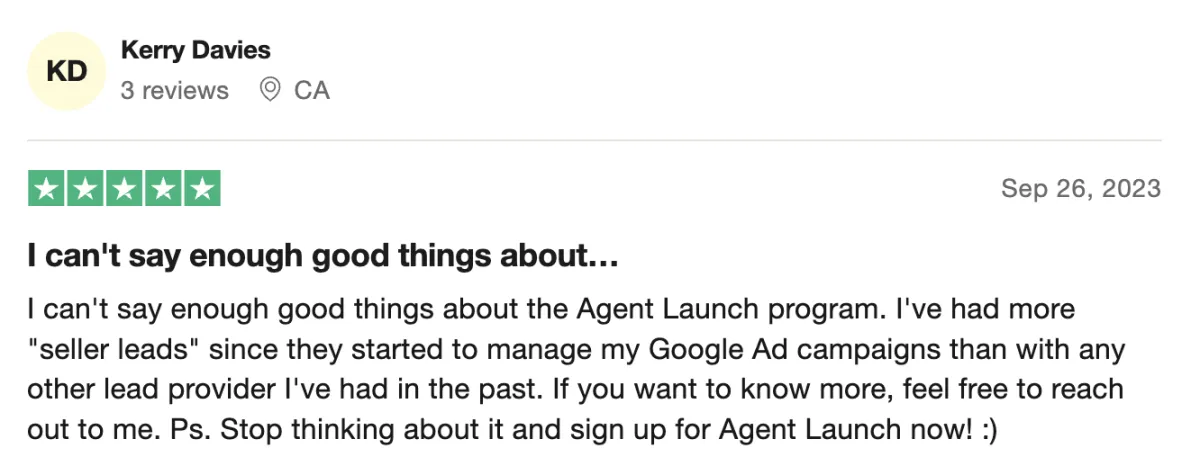

September 26, 2023

Kerry

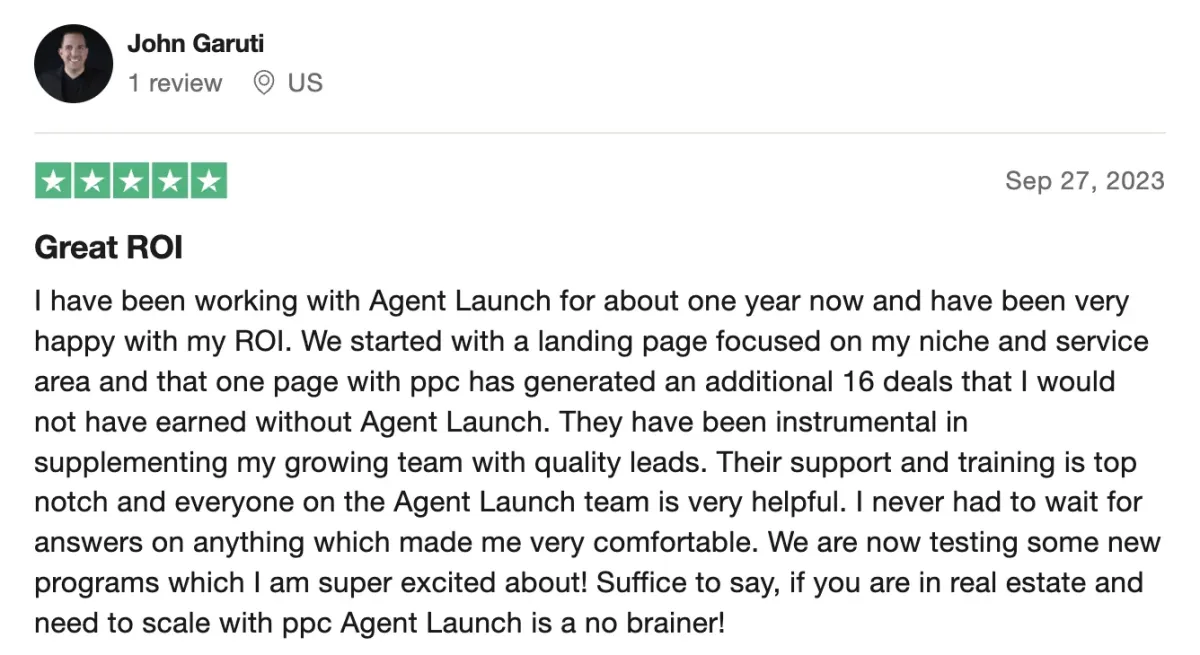

September 27, 2023

John

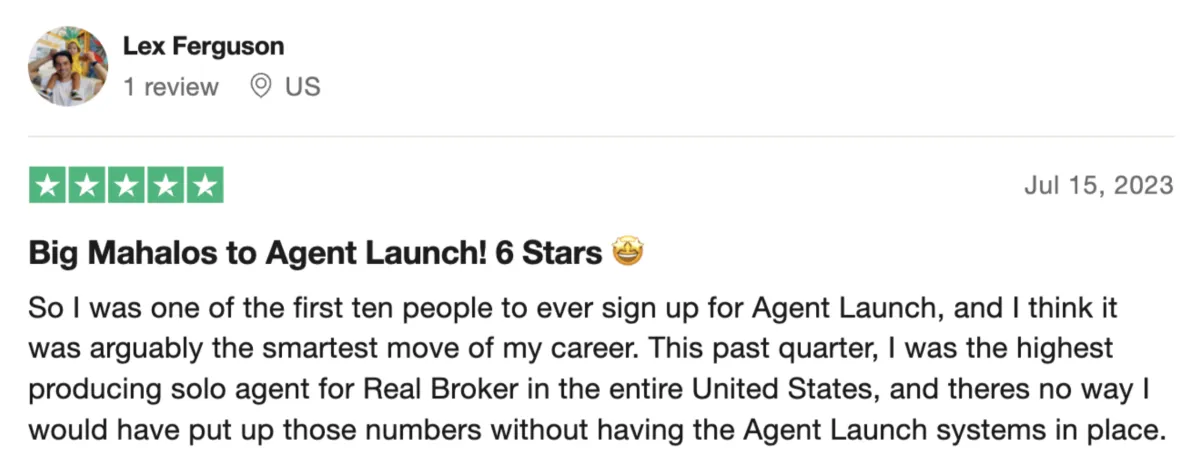

July 15, 2023

Lex

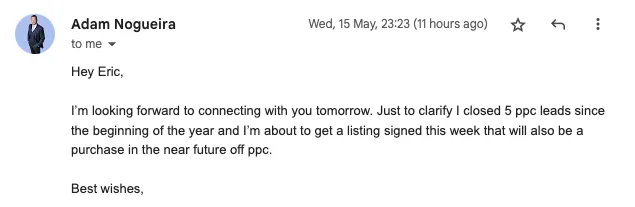

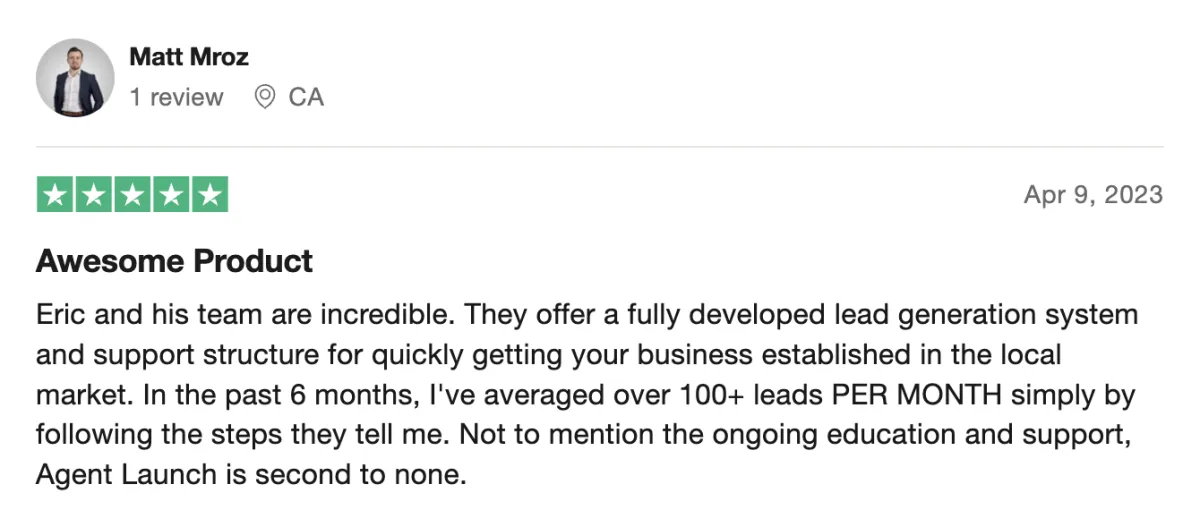

April 09, 2023

Matt

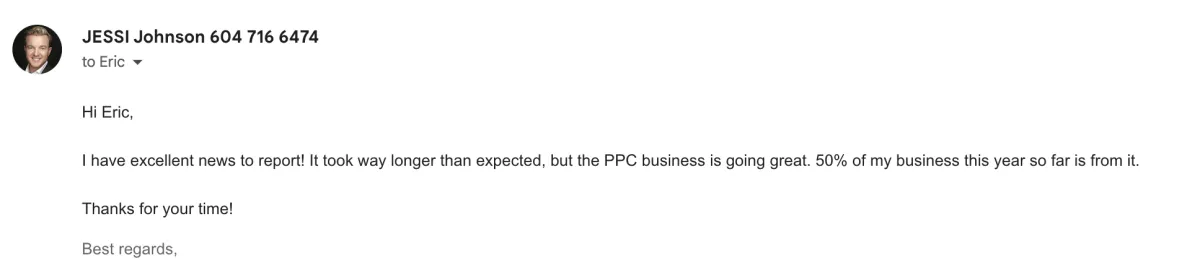

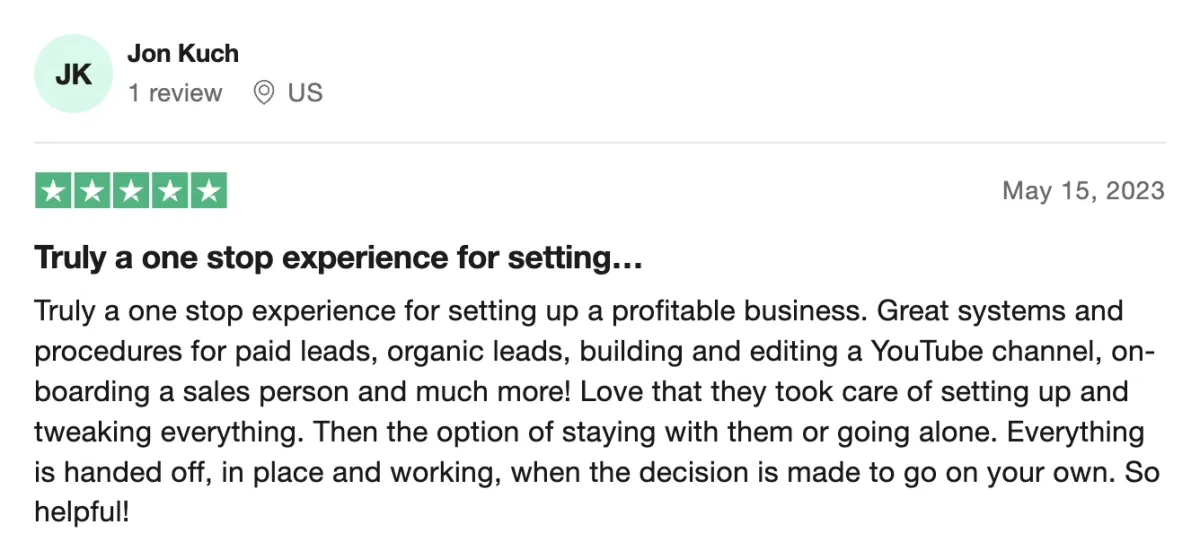

May 15, 2023

Jon

IMPORTANT: Earnings and Results Disclaimer

*Results and experiences do not guarantee similar results. Individual results may vary based on your skills, experience, motivation, and other unforeseen factors.

STILL NOT SURE?

FAQs

What is the minimum commitment?

Our minimum commitment is 3 months. This is the minimum it takes to really see the full picture results of this (but any) kind of lead generation in real estate.

How much should I budget for real estate lead generation?

Budgets can vary, but many agents start with a monthly budget of around $1,500 for online lead generation efforts. This allows for sufficient reach and the ability to test different strategies to see what works best.The minimum monthly spend for agent launch paid management is $1000/m.

How long does it take to start generating leads?

Generally, we can establish most clients' systems and have them fully functional within a 2-7 days of payment, ensuring that all essential components are correctly implemented and operational.

Are paid leads worth the investment?

Paid leads can be a valuable investment if they are high-quality and have a high conversion potential. We see the highest success with agents who are dedicated to online lead generation and willing to make the calls and follow our process. Speed to lead and having a good conversion system are major keys to success.

How does Agent Launch Generate leads?

Agent Launch generates leads through Google. Google is chosen because it attract buyers who have a high intent to purchase homes, ensuring that the leads we acquire are of high quality and relevance.

Are the leads shared?

With Agent Launch, leads are always exclusive and never shared, guaranteeing that each lead is solely yours and never given to multiple agents.

What's the difference between your Facebook & Google Ads services?

Our Google Ads are targeted at the resale market, and Facebook ads are targeted to people seeking new construction homes specifically for those interested. We find Facebook works best for new homes and Google works best for resale. If you are in a market with a lot of new construction, and want to target that market, Facebook will be the way to go.

What is the conversion rate of the leads?

While this is highly dependent on the agent and their motivation, Agent Launch clients have seen anywhere form 1-5% conversion rate with leads on a 24 month time horizon. Agents who have a tight follow up, nurture process, and can provide the most value to prospective clients see the highest returns.

It's time to meet your future clients

Connect directly with high-intent buyers ready to

find their new home.

©2021 Agent Launch LLC | Privacy Policy | Terms of Service

©2025 Agent Launch LLC | Privacy Policy | Terms of Service

2055 Limestone Rd STE 200-C, Wilmington, DE 19808